The CoCo Monitor provides the app subscribers the news, unbiased analysis and data on bond issuers and their contingent convertible (CoCo) notes. CoCo is a new asset class developed after the global financial crisis. Since 2012, the asset class has grown significantly. CoCo bond will remain a popular way for banks to raise capital due to new regulations, and also a popular investment for investors who understand the relative risks. Unfortunately, due to its complex contractual terms and issuers’ complex financial results, few investors really understand or see the relative value in this new asset class. CoCo has outperformed almost all other bond assets in the past turbulent year. CoCo now provides an attractive risk reward return to invest in the global banking industry.

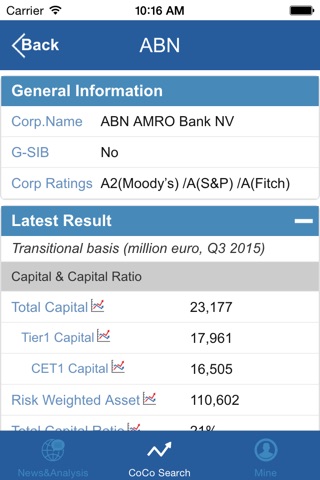

The app was developed with the aim to simplify the terms and data for our fellow investors. We provide summarized terms on each note and emphasize the key points investors need to know when considering an investment. We also provide key data on each issuer, not only the current quarter, but also historical data. Subscribers can use charts to see the trend in issuers’ capital or leverage ratio. Last but not least, we provide banks’ future target and relevant regulators’ requirements, so our users will know the outlook for the issuer. All these will provide greater clarity and help our customers make properly informed investment decisions.

We view CoCo as an attractive and fast changing asset class. We aim to put all relative materials in one app and build a great community for our fellow investors.

App Features:

-News/Analysis: Subscribers will get the latest market news on issuers, CoCo notes. Also, subscribers will get deep analysis from third party professional firms, covering every aspect including: accounting, legal issues, regulatory framework, etc.

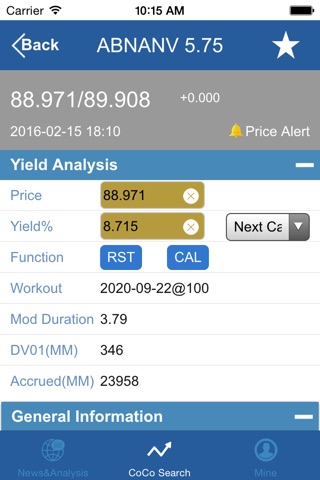

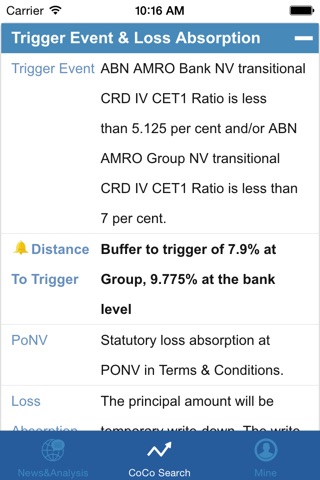

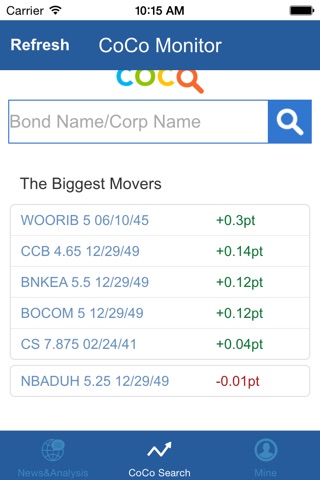

-Bond Search: A powerful search engine that enables our customers to find CoCo notes and the issuers. In each CoCo note page, we will provide detailed information on rating, coupon, redemption, trigger event etc. We will also provide real time market price on CoCo bonds. In each Issuer page, we will provide detailed information on the latest financial results, regulation, future targets etc.

-Alert: We provide price alert, distance-to-trigger alert, buffer to coupon restriction alert function to our subscribers. With this function, our subscribers will be notified when their predetermined levels are crossed.

-Other user friendly features: our customers can make their personal notes on each CoCo bond and save it for future review. We also provide materials like bond prospectus and issuers’ financial results on excel to our subscribers at their request.